Global warming is one of the burning issues of the 21st century. As we are looking for ways to reduce it, there have been a lot of initiatives penned down by different institutions from around the world. Green finance was one of such issues. It was gaining momentum during the last decade just to be juxtaposed by Covid-19. The urgency of the climate crisis is now more evident with the picture of uncertainty the pandemic has painted before us. Not only did this disease question the fragility of the healthcare and education system around the world but also showed the ineffectiveness of realizing environmental policies. But amidst all socio-economic policies, will green finance lose its relevance or show a new way to rebalance responsible investment?

What is Green Finance?

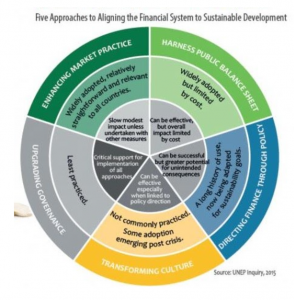

According to the United Nations Environment Programme, Green Financing is a method of increasing the transfer of financial flows from public, private, and non-profit sectors to sustainable development goals and priorities. Key parts of it include management of environmental and social risks and charting out policies that bring maximum environmental benefit and a decent rate of return. It can be promoted through changes in regulatory frameworks of various countries, channelizing public financial incentives, encouraging green financing in different sectors, alignment of public sector financing with the environmental dimension of the Sustainable Development Goals, clean and green technologies investments, financing climate-smart blue economy (encouraging preservation of marine environment), increasing the usage of green bonds, etc.

Evolution of Green Financing

The term first earned its relevance in the G20 Summit in the year 2016 with the establishment of the Green Finance Study Group (GFSG). It was treated as a broad umbrella to address a shift in financial flows to support projects that benefit the environment and work towards the reduction of pollution. Another term used was climate finance which is a subset of green finance. While climate finance deals with more transfer of resources by the government (public finance) to sustainable efforts, green finance includes this with the advocacy of financial instruments and business policies that reduce carbon footprints and pollution. Green finance applies to all sectors including government. It was also an important agenda for the 2015 Paris Agreement on Climate Change. Green finance is becoming increasingly sophisticated, with new frameworks, initiatives, and financial products emerging, and a growing distinction between the use of risk reducers (to not employ unsustainable policies which encourage damage) and impact investing.

Importance Then

As the internet gained importance in our daily activities from the advent of the 21st century, banks are now opting for online methods to provide for customers. Opening online bank branches and having local branches reduce the transportation hassle by customers in return reduces carbon emissions from vehicles. In this way, the whole system can be organized online, thus contributing to green banking. These operations especially came to relevance on and post 2010. When it comes to other efforts, green bonds launched by the World Bank in 2010 were also a landmark. Green bonds are created to fund projects that have positive environmental and climate benefits. The majority of them issued are asset-linked bonds. Proceeds from these bonds are bookmarked for green projects but are backed by the issuer’s entire balance sheet. Green finance gained a lot of attention from 2010 till 2019, slowly gaining the confidence of investors, governments, and Fortune 500 companies. It was also one of the most important agendas of the Davos Summit in January 2020. It was until Covid-19 lurked into our daily activities in March 2020.

As the internet gained importance in our daily activities from the advent of the 21st century, banks are now opting for online methods to provide for customers. Opening online bank branches and having local branches reduce the transportation hassle by customers in return reduces carbon emissions from vehicles. In this way, the whole system can be organized online, thus contributing to green banking. These operations especially came to relevance on and post 2010. When it comes to other efforts, green bonds launched by the World Bank in 2010 were also a landmark. Green bonds are created to fund projects that have positive environmental and climate benefits. The majority of them issued are asset-linked bonds. Proceeds from these bonds are bookmarked for green projects but are backed by the issuer’s entire balance sheet. Green finance gained a lot of attention from 2010 till 2019, slowly gaining the confidence of investors, governments, and Fortune 500 companies. It was also one of the most important agendas of the Davos Summit in January 2020. It was until Covid-19 lurked into our daily activities in March 2020.

Importance Now

The urgency of the climate crisis is now more evident with the picture of uncertainty the pandemic has painted before us. As the world faced lockdown, daily commutes and activities came to a halt. In return, we could see an improvement in the weather and climatic conditions. Air pollution drastically dropped in all the major metropolitan cities. The marine environment also became cleaner as there were fewer disposals. This raised questions about the efficacy of the environmental sustainability agreements already made. But there’s also the fragility of health, education, and other social institutions. This is seemingly jeopardizing the importance of green financing. In an article of Bloomberg recently, Riksbank of Sweden warned that rising temperatures imply monetary policy can’t ignore the fallout of carbon emissions. This means that global warming can lead to a catastrophic effect, that is, a lower interest rate. According to Mark Oliphant of the International Stock Exchange, while green bond issuance has faded since the onset of Covid-19, issuances of sustainability and social bonds have accelerated. As there is surging unemployment and non-availability of healthcare, corporations are issuing bonds targeted at UN sustainable development goals. Bonds are more socio-economic [keeping in mind social and governance (ESG) factors] than green or rather a combination of both. So the singular attention green bonds gained pre-Covid-19 started waning. Oliphant added that there will be a rebalancing between various considerations of responsible investing. It doesn’t appear that the pandemic will completely shift allocations from green finance into social initiatives. In November 2020, the World Economic Forum supported the virtual Green Horizon Summit organized by the City of London Corporation in collaboration with the Green Finance Institute to focus on the role of green finance in improving our lives during COVID-19. The agenda included getting net-zero emissions, advocating carbon credit and carbon border fees, designing a digital economy, the launch of the Earthshot Prize (designed to incentivize change and help to repair our planet over the next ten years), etc.

The urgency of the climate crisis is now more evident with the picture of uncertainty the pandemic has painted before us. As the world faced lockdown, daily commutes and activities came to a halt. In return, we could see an improvement in the weather and climatic conditions. Air pollution drastically dropped in all the major metropolitan cities. The marine environment also became cleaner as there were fewer disposals. This raised questions about the efficacy of the environmental sustainability agreements already made. But there’s also the fragility of health, education, and other social institutions. This is seemingly jeopardizing the importance of green financing. In an article of Bloomberg recently, Riksbank of Sweden warned that rising temperatures imply monetary policy can’t ignore the fallout of carbon emissions. This means that global warming can lead to a catastrophic effect, that is, a lower interest rate. According to Mark Oliphant of the International Stock Exchange, while green bond issuance has faded since the onset of Covid-19, issuances of sustainability and social bonds have accelerated. As there is surging unemployment and non-availability of healthcare, corporations are issuing bonds targeted at UN sustainable development goals. Bonds are more socio-economic [keeping in mind social and governance (ESG) factors] than green or rather a combination of both. So the singular attention green bonds gained pre-Covid-19 started waning. Oliphant added that there will be a rebalancing between various considerations of responsible investing. It doesn’t appear that the pandemic will completely shift allocations from green finance into social initiatives. In November 2020, the World Economic Forum supported the virtual Green Horizon Summit organized by the City of London Corporation in collaboration with the Green Finance Institute to focus on the role of green finance in improving our lives during COVID-19. The agenda included getting net-zero emissions, advocating carbon credit and carbon border fees, designing a digital economy, the launch of the Earthshot Prize (designed to incentivize change and help to repair our planet over the next ten years), etc.

What Are Its Ripples?

Green finance is promising, taking into consideration the current situation. A multi-stakeholder partnership is encouraged in this process which means a rigorous collective follow-through can positively impact climate and society. But there are some negative externalities to this agenda. Effects of Green finance are long-term which means setting target years to achieve a goal. So achieving one is a part of this huge process. But climate change is rapidly changing for the worse. Keeping up with its pace will be difficult. Secondly, the initial investment in green finance is expensive. Though future cost reduces drastically and encourages savings. Lastly, finding trustworthy investors and other institutions according to an organization’s needs. As this is a relatively emerging business model, zoning in a legitimate partner is daunting yet important.

Final Thoughts

Green finance doesn’t precisely define which assets are green, yet, as it’s at a developing stage. This leaves companies and investors in a dilemma. There’s also a gap between the needs of green finance and existing financial flows. Thanks to uninformed investors. Investor education also needs to be cultured if the finance industry wants to cash on “going green”. While social benefits are important, a better climate can make the living conditions more conducive and facilitate economic growth around the world. And green finance can be that groundbreaking path.

References

- “Will Covid-19 Take the Steam out of Green Finance? | Reuters Events | Sustainable Business.” Accessed April 9, 2021. https://www.reutersevents.com/sustainability/will-covid-19-take-steam-out-green-finance

- “Green Horizon Summit: The Pivotal Role of Finance | World Economic Forum.” Accessed April 9, 2021. https://www.weforum.org/events/green-horizon-summit-the-pivotal-role-of-finance-2020

- Heinrich-Böll-Stiftung. “Green Finance and Climate Finance | Heinrich Böll Stiftung.” Accessed April 9, 2021. https://www.boell.de/en/2016/11/30/green-finance-and-climate-finance

- “A Hotter Planet Has Sweden Predicting a New Monetary Policy Era – Bloomberg.” Accessed April 9, 2021. https://www.bloomberg.com/news/articles/2021-03-24/sweden-says-global-warming-could-alter-future-of-monetary-policy

- Environment, U. N. “Green Financing.” UNEP – UN Environment Programme, January 23, 2018. http://www.unep.org/regions/asia-and-pacific/regional-initiatives/supporting-resource-efficiency/green-financing

Image References

- Environment, U. N. “Green Financing.” UNEP – UN Environment Programme, January 23, 2018. http://www.unep.org/regions/asia-and-pacific/regional-initiatives/supporting-resource-efficiency/green-financing

- Sustainability Times. “Ukraine’s New Climate Vision Is Still Wanting,” February 13, 2020. https://www.sustainability-times.com/environmental-protection/is-ukraines-new-climate-vision-good-enough/